29+ Installment Agreement Request Form 9465

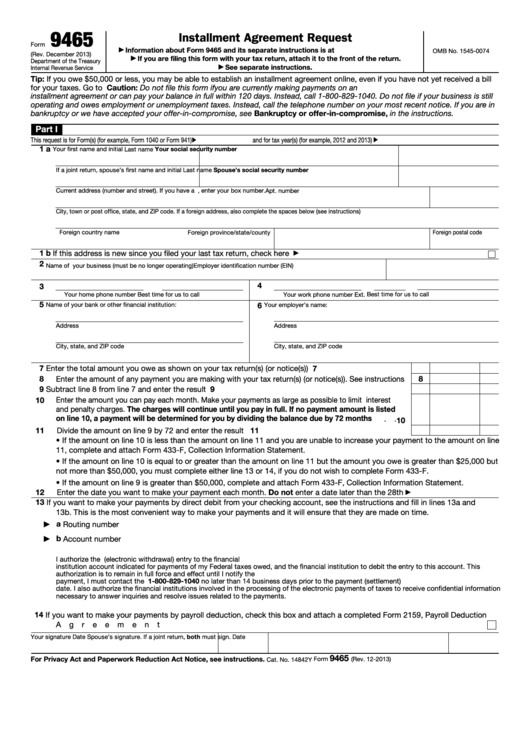

Irs form 9465 installment agreement request is used if you are requesting an installment agreement for balances owed of less than $50,000. If you can't use the irs's online payment agreement, or you don't want to call the irs, you can use form 9465 (installment agreement form) to request a payment plan.this form is primarily for individuals. If you are filing this form with your tax return, attach it to the front of the return. Federal — installment agreement request download this form print this form. The irs will conduct a thorough review of your finances with detailed information on your income, investments, assets and bank accounts.

Watch the video below for tips that will help you become an expert for the 9465 application form, rate agreement.

If the taxpayer cannot pay the total tax currently due but would like to pay the tax due through an installment agreement request form 9465: Businesses can only use this form if they are out of business. Watch the video below for tips that will help you become an expert for the 9465 application form, rate agreement. Most installment agreements meet our streamlined installment agreement criteria. If you are filing this form with your tax return, attach it to the front of the return. Completing the form online can reduce your installment payment user fee, which is the fee the irs charges to set up a payment plan. The irs will conduct a thorough review of your finances with detailed information on your income, investments, assets and bank accounts. If you owe less than $50,000 (including penalties and interest), you can use the irs's online payment agreement to apply. For more information on the irs collection process and what to do if you are unable to pay your taxes in full, visit pub. If you use the form and direct debit, the fee is $107 or $31 if you use the online payment agreement. Do not file this form if you are currently making payments on an installment agreement or can pay your balance due in full within 120 days. If you don't want to use the irs's online tool to request a payment plan (or you owe too much money to use the online tool), you can use irs form 9465 (installment agreement form). Instructions for form 9465 (sp), installment agreement request (spanish version) 1120 11/10/2020 form 13844:

Click on miscellaneous forms from the enter data tab to expand that section.; If you owe less than $50,000 (including penalties and interest), you can use the irs's online payment agreement to apply. 9465 installment agreement request form omb no. If the taxpayer cannot pay the total tax currently due but would like to pay the tax due through an installment agreement request form 9465: Employers engaged in a trade or business who pay compensation form 9465;

This form is mainly for individuals.

Businesses can only use this form if they are out of business. Ask questions, get answers, and join our large community of tax professionals. December 2011) department of the treasury internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. If you can't use the irs's online payment agreement, or you don't want to call the irs, you can use form 9465 (installment agreement form) to request a payment plan.this form is primarily for individuals. Completing the form online can reduce your installment payment user fee, which is the fee the irs charges to set up a payment plan. Click here to check the instructions for a missed contract request. File form 9465, installment agreement request, to set up installment payments with the irs. Specifically, form 9465 is for setting. A man types his credit card number into his computer. The applicable fee is $225 or, if you sign an online agreement, $149. You may qualify to pay the irs in installments. December 2008) if you are filing this form with your tax return, attach it to the department of the treasury front of the return. Click on miscellaneous forms from the enter data tab to expand that section.;

And the form instructions tell you that if it didn't come with some of your info filled in by the irs, you fill it in. A man types his credit card number into his computer. If you can't use the irs's online payment agreement, or you don't want to call the irs, you can use form 9465 (installment agreement form) to request a payment plan.this form is primarily for individuals. Irs form 9465 is a collections form for when your client owes back taxes to the irs. 1 your first name and initial last name your social security number if a joint return, spouse's first name and initial

Completing the form online can reduce your installment payment user fee, which is the fee the irs charges to set up a payment plan.

form 9465 (sp) installment agreement request (spanish version) 2020 inst 9465 (sp) instructions for form 9465 (sp), installment agreement request (spanish version) 2020 inst 9465 (sp) instructions for form 9465 (sp), installment agreement request (spanish version) 2019 form 9465 (sp) If you are filing irs form 9465, you can make payments via check, money order, or credit card. Hit the green arrow with the inscription next to move on from field to field. Do not file this form if you are currently making payments on an installment agreement or can pay your balance due in full within 120 days. In particular, form 9465 is used if you put in place a missed contract or payment plan on behalf of your client. Do not file this form if you are currently making payments on an installment agreement or can pay your balance in full within We will update this page with a new version of the form for 2022 as soon as it is made. Download or print the 2020 federal form 9465 (installment agreement request) for free from the federal internal revenue service. This form is mainly for individuals. We last updated federal form 9465 in january 2021 from the federal internal revenue service. If you are filing this form with your tax return, attach it to the front of the return. form 9465 installment agreement request. One set of addresses is for taxpayers who filed form 1040 with schedule(s) c, e, or f for the tax year for which the installment agreement is being requested.

29+ Installment Agreement Request Form 9465. The setup fee for an installment agreement for this form is $225 (as of 2017) and $107 for direct debit. December 2011) department of the treasury internal revenue service installment agreement request if you are filing this form with your tax return, attach it to the front of the return. Specifically, form 9465 is for setting. In the installment agreement section, you can fill in the information for form 9465 to send in with your tax return. City, town or post office, state, and zip code if a foreign address, enter city, province or state, and country follow the country's practice for entering the postal codethe financial institution account indicated for payments of my federal taxes owed, and the financial institution to debit the entryi authorize the u s treasury and.

0 Response to "29+ Installment Agreement Request Form 9465"

Post a Comment