16+ Irs Online Payment Agreement

However, the department will make exceptions to that rule for special cases. The less you pay each month, the more you'll end up paying in penalties and interest. When i do the payment plan online, i get the following error: Please select your tax form information. To use the tool, you must be an authorized representative (i.e., you must have a signed power of attorney on file with the irs).

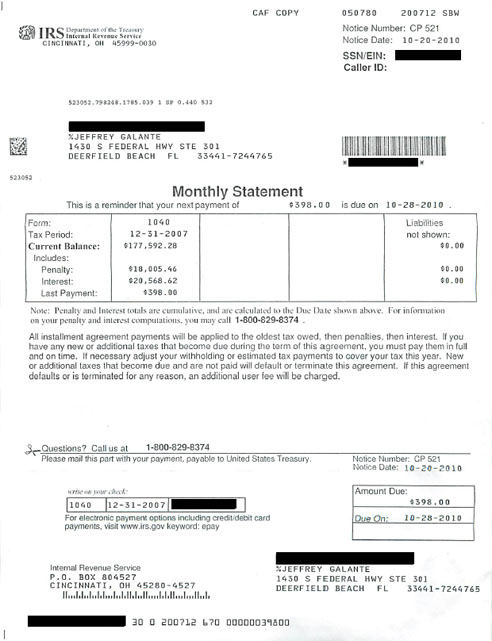

The online payment agreement (opa) is a tool that practitioners and taxpayers can use to apply for certain types of payment agreements with the irs.

Pay irs installment agreements and other personal and business taxes quickly & The takeover tool allows qualified taxpayers … Click here to set up a payment plan for amounts owed to the irs. Individual income tax return payment options. Another benefit of paying off your tax debt is that you'll once again be able to receive a tax refund check. Each year, almost 4 million taxpayers obtain an irs installment agreement. Installment payment agreement (ipa) if you're unable to pay your tax bills in full, you may qualify for an installment payment agreement (ipa). Fees for irs installment plans. I am trying to create a payment plan to pay the irs money but nothing works. To use the tool, you must be an authorized representative (i.e., you must have a signed power of attorney on file with the irs). In order to do so, the irs will typically verify whether current tax payments have been made (depending on the type of installment agreement you qualify for). When setting up a payment plan with the irs online, you need to see if you qualify first. I didn't receive approve or reject for my installment payment plan.but today i received cp14 letter about my tax due with deadline of payment in 2 weeks.

Credit cards 1.99% ($2.58 minimum) consumer/personal debit cards $2.58. Fees for irs installment plans. online payment agreement application irs tax forms. Simply find the tax item and select a payment option. As far as we know the irs website is simply broken.

The convenience fee for this service is $2.58 for consumer/personal debit cards, or 1.99% of the tax payment amount for credit cards and all other debit cards (minimum of $2.58).

The california ftb and the irs are separate government agencies and have their own rules for payment plans. Individual income tax return payment options. To be approved for a payment plan, you must have filed all tax returns through the. It may take up to 60 days to process your request. Fees for irs installment plans. online, directly from your bank account (free) Click here to set up a payment plan for amounts owed to the irs. Experience the convenience of electronic tax payments with pay1040.com's low fees. With that balance due you could request a direct debit installment agreement for as little as $25 per month and probably be approved. "form 9465 installment agreement request," By setting up a plan, you'll avoid collection actions, like tax liens and tax levies. For those individuals or businesses not able to resolve their tax obligation immediately, arranging a payment agreement online can be a reasonable option. Proudly founded in 1681 as a place of tolerance and freedom.

To be approved for a payment plan, you must have filed all tax returns through the. "publication 5426, taxpayer first act, report to congress," "form 9465 installment agreement request," It is like irs never received my installment payment plan application. Installment agreement user fees range from $225 for a payment arrangement set up by phone or mail and paid by monthly checks to $31 for a payment agreement set up online and paid by direct debit.

Credit cards 1.99% ($2.58 minimum) consumer/personal debit cards $2.58.

As an added benefit, the convenience fee is tax deductible on business tax payments and on qualified personal tax payments. Typically, you will have up to 12 months to pay off your balance. Welcome to the comptroller of maryland's online payment agreement request service. Form 9465 is available in all versions of taxact® and can be electronically filed with your return. A payment installment plan is an agreement between you and the illinois department of revenue to pay your tax delinquencies using a monthly payment plan. Installment agreement user fees range from $225 for a payment arrangement set up by phone or mail and paid by monthly checks to $31 for a payment agreement set up online and paid by direct debit. An irs payment plan is an agreement that gives you an extended period of time to pay off the taxes you owe. A 0.5% monthly penalty, plus interest (set at 3% annually for the first quarter of 2021 for individuals) will accrue until you've paid off your. Before the irs will accept a payment plan, they will want to ensure another tax liability is not going to occur next year. The irs makes it easy to sign up for an installment agreement to pay your taxes over time when you find it difficult to pay the entire amount upfront. Social secuirty number (primary's if jointly filed) tax year (s) tax form or notice number (e.g., form 1040) mail the payment as follows: online payment agreement (opa) we are unable to complete the transaction you requested. Generally, in order to establish a payment plan, the amount of tax due must be greater than $100.

16+ Irs Online Payment Agreement. The takeover tool allows qualified taxpayers … online payment agreement (opa) we are unable to complete the transaction you requested. To set up an installment agreement, taxpayers or their representatives may call the irs, use the irs's online payment agreement (opa) tool, or file form 9465, installment agreement request. Start paying your taxes online with the iowa department of revenue's easypay tool. Through your account, you can request an ipa for a balance of $20,000 or less, and with 36 or fewer scheduled monthly payments.

0 Response to "16+ Irs Online Payment Agreement"

Post a Comment